【程式交易實戰 10】打造多策略組合,讓你穩穩睡好覺

內含 fugle_trade 下單套件,該套件已不再更新,下單語法請改用 合作券商 之 SDK

歡迎來到 程式交易實戰 的最後ㄧ堂課,在本系列文章中介紹了許多交易策略,可以發現不同的策略會有不同的特性,您還在尋找策略聖杯嗎?也許多個策略組合能夠有效幫助您降低風險,得到更平穩的報酬,我們不妨試著組合多個策略,進一步打造更平穩的報酬吧!

讀完本篇文,您將學會...

- 透過庫存個股進行移動停損停利實單演練

多策略組合介紹

在程式交易實戰系列文章中,介紹了許多交易策略,可以發現不同的策略各有特色,有些策略是獲利高、回檔大、交易次數多,有些策略是獲利普通、回檔小、交易次數少。通常不同策略所帶來的獲利週期往往也不一致。在開發策略時會希望將策略調整到完美的狀態,但同時也相當容易掉入過度擬和(Overfitting)的陷阱中,我們可以試著將多個策略組合起來,觀察策略之間是否有互補性,進而降低單一策略容易遇到的潛在風險。

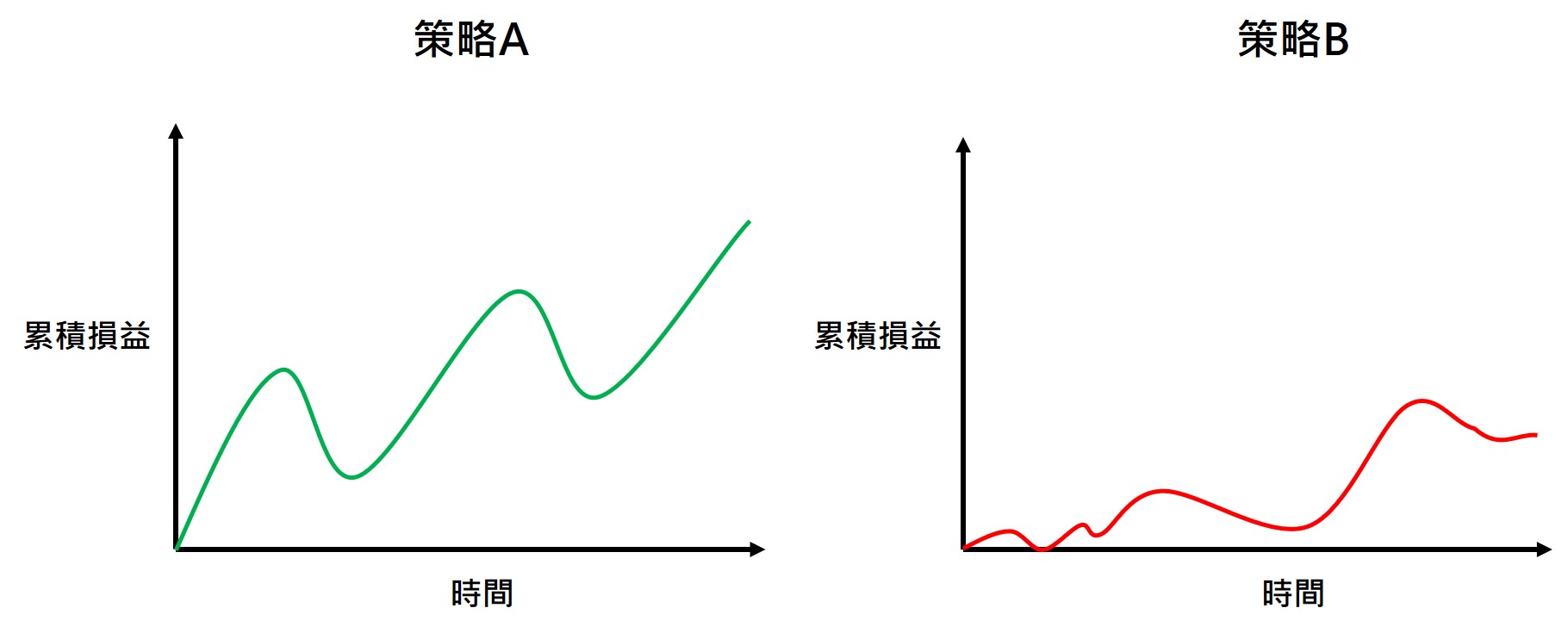

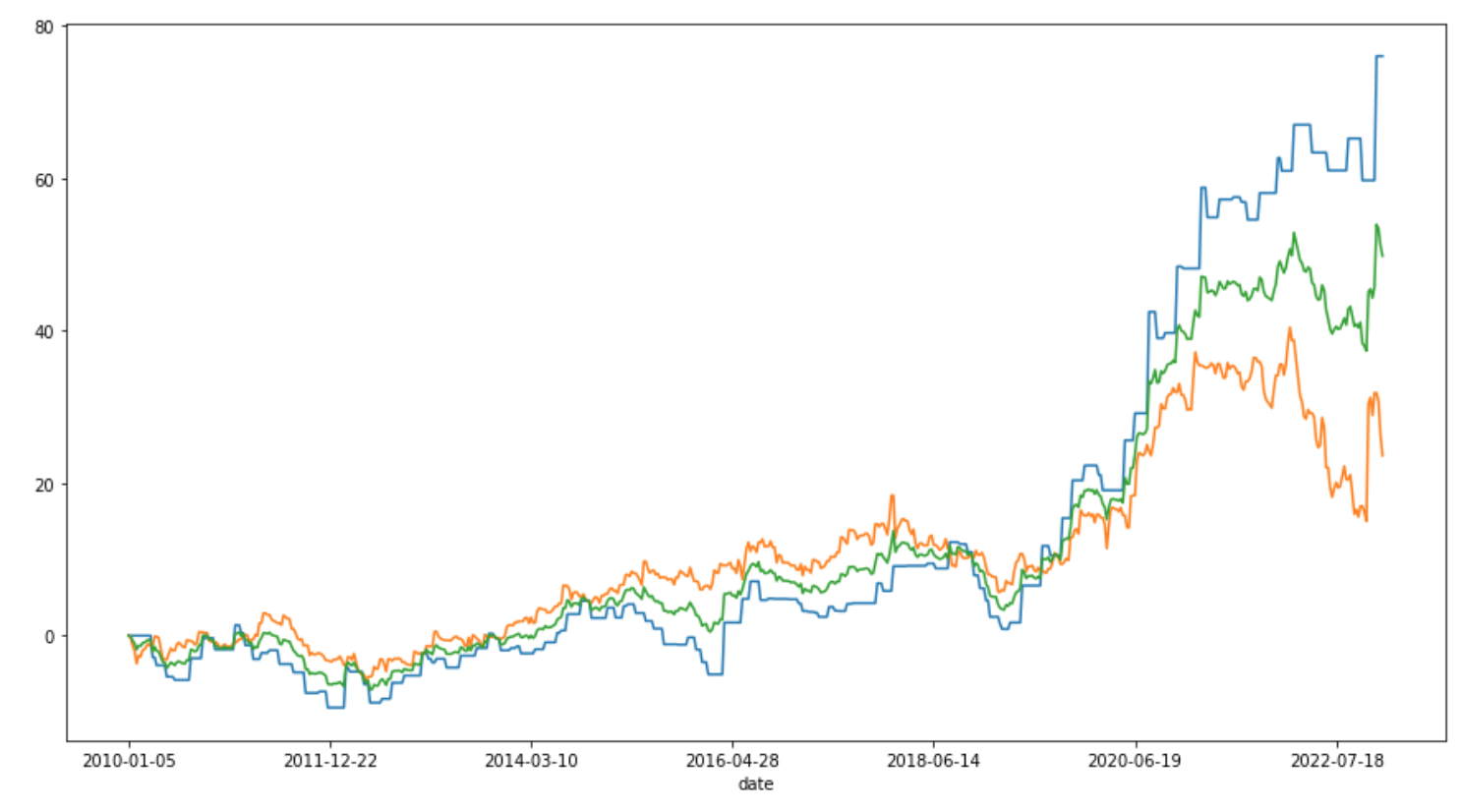

假設有A、B兩支交易策略,他們的損益曲線如下圖,我們可以觀察到:

- 策略A:絕對獲�利大,回檔大

- 策略B:絕對獲利小,回檔小

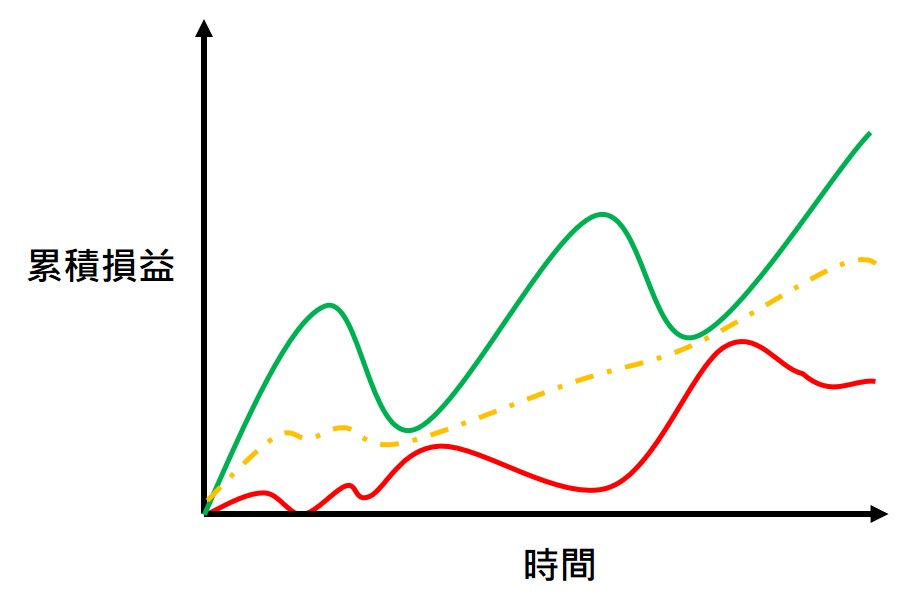

通常我們會認為策略B是一個較差的策略,因為他最後的報酬不理想,但事實上可以觀察到兩個策略的【獲利分布是不一樣的】,可以將兩個策略疊合起來會看得更清楚。可以發現疊合後的獲利雖然不如策略A,但是它的回檔降低了非常多,如此以來我們就可以較有信心使用這個策略組合。

以下我們就一樣以 0050 為標的,試著建構 2 種策略將它們組合起來並討論組合後的效果。

- 策略1:MACD 柱狀翻紅買進1張、翻黑賣出1張

- 策略2:紅 K 並且收盤突破昨日高點就買進1張、收黑K賣出1張。

首先取得 0050 的日 K 歷史資料,回測期間為 2010/1/1 至 2022/12/22!

策略回測

step1. 載入相關套件

# 載入富果 API 相關套件

from fugle_marketdata import (WebSocketClient, RestClient)

from configparser import ConfigParser

from fugle_trade.sdk import SDK

from fugle_trade.order import OrderObject

from fugle_trade.constant import (APCode, Trade, PriceFlag, BSFlag, Action)

# 載入相關套件

import matplotlib.pyplot as plt

import numpy as np

import requests

import pandas as pd

import time

step2. 取得歷史數據

# 輸入行情 API Token

key = 'INPUT_YOUR_API_KEY'

client = RestClient(api_key = key)

stock = client.stock # Stock REST API client

symbol = "0050" # 股票代碼

candles_list = []

for y in range(2010,2023):

start_date = str(y)+"-01-01" # 選擇資料起始日期

end_date = str(y)+"-12-31" # 選擇資料結束日期

history_options = {"symbol": symbol, "from": start_date, "to": end_date,

"timeframe":"D", "fields":"open,high,low,close,volume,change,turnover"}

historical_data = stock.historical.candles(**history_options)

# 將資料轉為 dataframe 方便回測

candles_list = candles_list + historical_data['data']

df = pd.DataFrame(candles_list).sort_values('date').set_index('date')

step3. 策略回測撰寫

策略 1 使用 MACD 指標,這裡引入 talib 函式庫來計算!

import talib

df['MACD'], df['MACDSignal'], df['MACDhist'] = talib.MACD(df['close'],12,26,9)

MACD 指標計算完畢後就可以開始來撰寫策略 1 的內容了。 首先在第一天先買進一張作為初始部位,方便後面的日期繼續回測。另外因為策略內容需要比較前一天的數據,所以需要從第 2 天開始回測。

buy_price = df.iloc[0]['close']

strategy1_record = []

for d in df[1:].iloc:

# 如果今日的MACD柱跟昨天不同向

if d['MACDhist'] * df.loc[d.name-1,'MACDhist'] < 0:

# 翻紅買進

if d['MACDhist'] > 0:

buy_price = d['close']

# 翻黑賣出

elif d['MACDhist'] < 0:

strategy1_record.append({'date': d['date'], 'profit': d['close'] - buy_price})

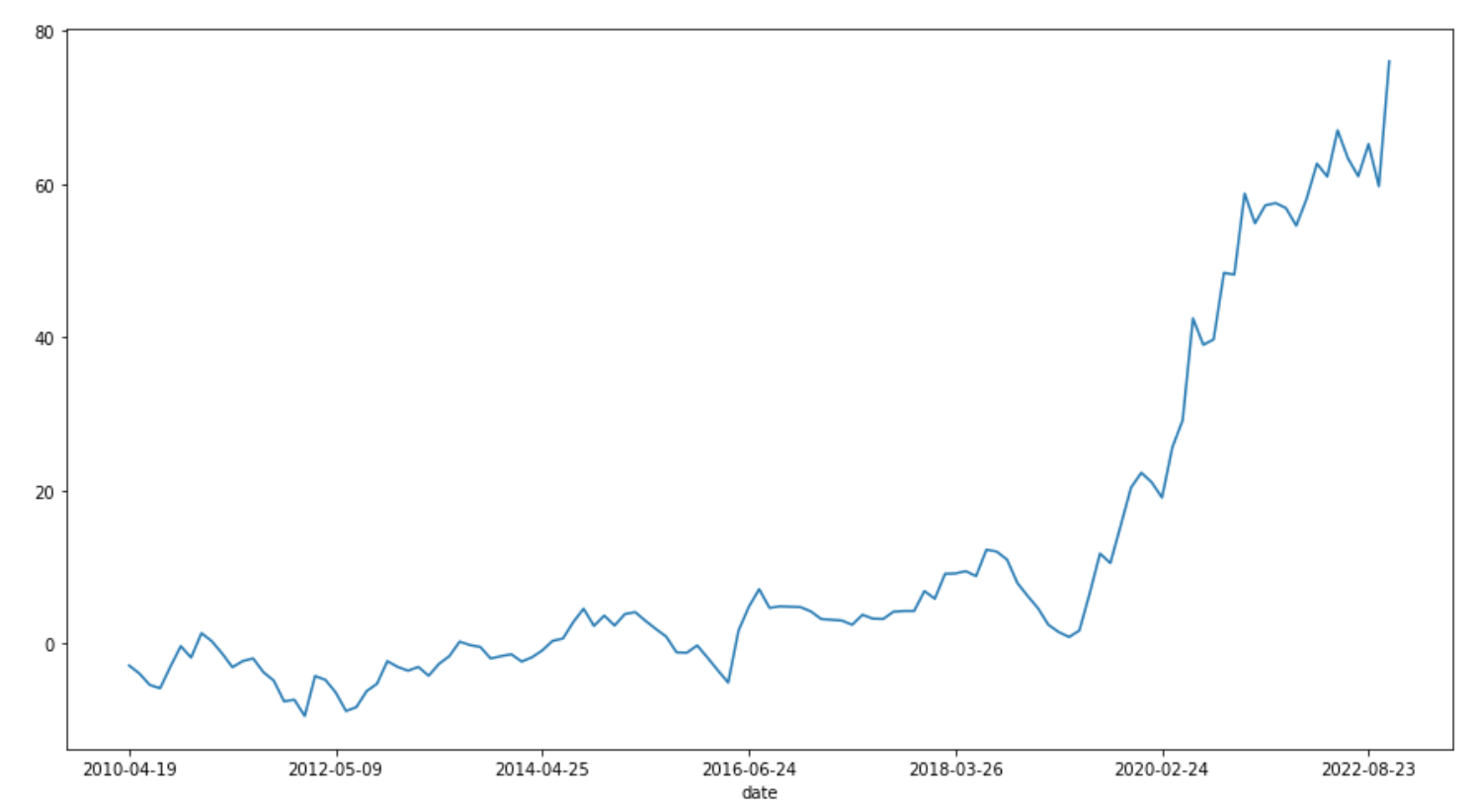

當部位出場時會將每次的損益都記錄在 strategy1_record 裡,有了每一筆損益後就可以畫出累積損益圖,繪製如下:

import matplotlib.pyplot as plt

strategy1_plotdf = pd.DataFrame(strategy1_record).set_index('date')

strategy1_plotdf['profit_cumsum'] = strategy1_plotdf['profit'].cumsum()

strategy1_plotdf['profit_cumsum'].plot(figsize=(15,8))

我們可以觀察到主要的獲利都是 2020 年至 2022 年之間,過程中也有數次較大的回檔。 以下我們再繼續實作策略 2,一樣在第一天就先買進 1 張,並從第二天開始回測。

buy_price = df.iloc[0]['close']

position = 1

strategy2_record = []

for d in df[1:].iloc:

# 如果沒有部位 當天是紅K 並且收過昨天高點

if position == 0 and d['close'] > d['open'] and d['close'] > df.loc[d.name-1,'high'] :

position = 1

buy_price = d['close']

# 如果有部位 當天是黑K

elif position == 1 and d['close'] < d['open'] :

position = 0

strategy2_record.append({'date': d['date'], 'profit': d['close'] - buy_price})

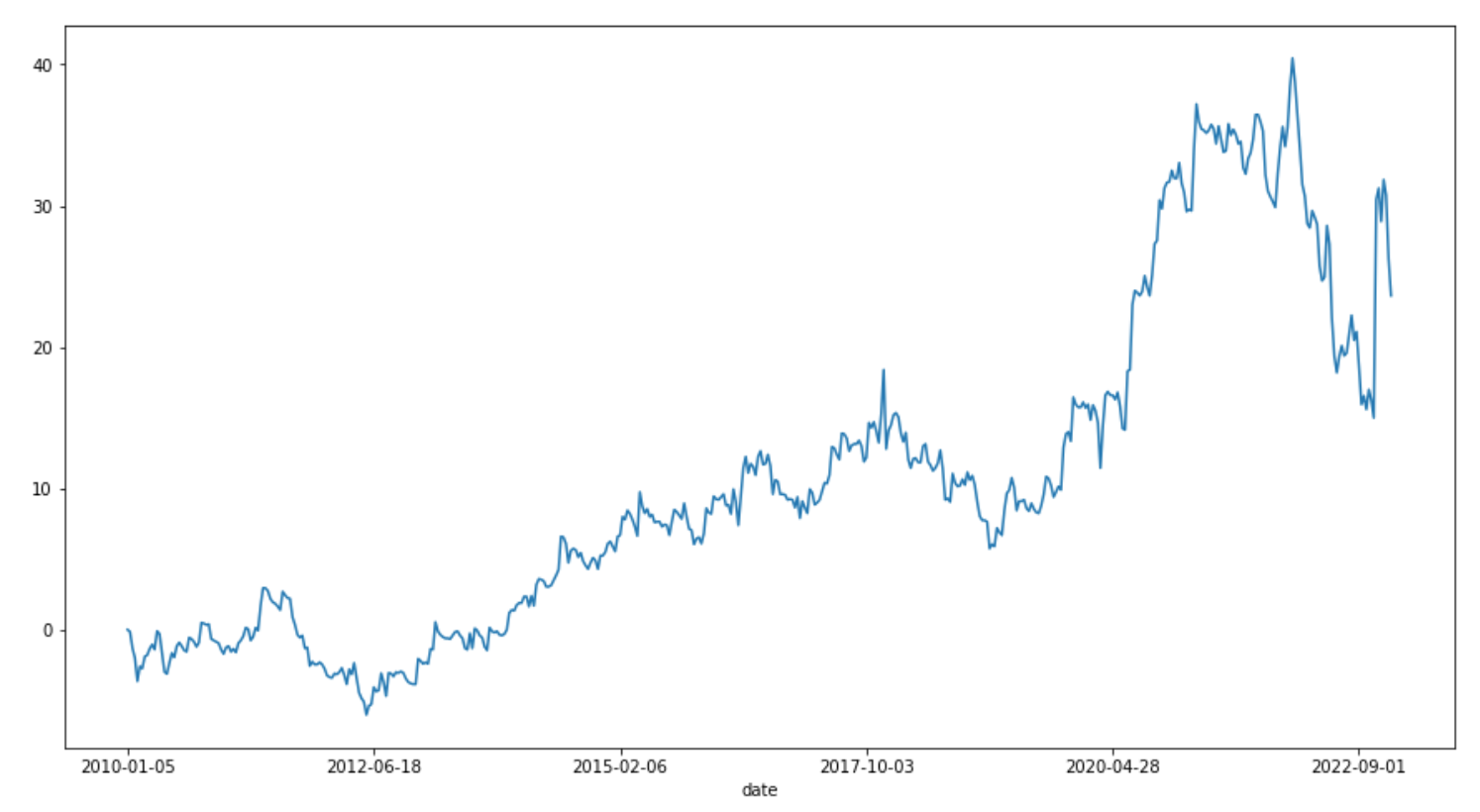

累積損益圖如下:

我們可以觀察到這組策略的獲利不如策略 1,在 2022 年的回檔也很大,但值得注意的是它的獲利分布比較廣,有助於補足策略 1 在 2012-2018 年績效較普通的情況。於是以下我們就將兩組策略的累積損益圖疊加後來進行比較!

由上圖就可以觀察到總合兩個策略可以達成縮小回檔、增加獲利穩定性的目標,較穩定的策略才有助於我們有足夠的信心來繼續執行這個策略。

def calculate_performance(pl_record):

df = pd.DataFrame(pl_record)

df['profit_cumsum'] = df['profit'].cumsum()

pl_list = list(df['profit'])

winrate = len([x for x in pl_list if x > 0]) / len([x for x in pl_list if x <= 0])

odds = ( sum([x for x in pl_list if x > 0]) / len([x for x in pl_list if x > 0]) ) / abs( sum([x for x in pl_list if x <= 0]) / len([x for x in pl_list if x <= 0]) )

profit_factor = sum([x for x in pl_list if x > 0]) / abs(sum([x for x in pl_list if x <= 0]))

df['drawdown'] = df['profit_cumsum'] - df['profit_cumsum'].cummax()

maximum_drawdown = np.min(df["drawdown"])

print("勝率", round(winrate*100,2) ,"%")

print("賺賠比", round(odds,2))

print("獲利因子",round(profit_factor,2))

print('MDD', round(maximum_drawdown,2))

print("策略1:")

calculate_performance(strategy1_record)

print("----------------")

print("策略2:")

calculate_performance(strategy2_record)

print("----------------")

print("策略組合:")

combine_dict_list =[]

for d in combine_df.iloc:

combine_dict_list.append({'date': d.name, 'profit': d['total_avg']})

calculate_performance(combine_dict_list)

Response

策略1:

勝率 89.23 %

賺賠比 2.07

獲利因子 1.84

MDD -11.4

----------------

策略2:

勝率 74.24 %

賺賠比 1.52

獲利因子 1.13

MDD -25.45

----------------

策略組合:

勝率 79.31 %

賺賠比 1.73

獲利因子 1.37

MDD -15.53

以評估指標來檢視三種策略可以發現,組合策略皆是介於策略 1 與策略 2 之間,較可惜的是組合策略的 MDD 還是大於策略 1,由損益圖可以發現主要是在 2022 年受到策略 2 的影響,若能調整策略資金配置比例或許是解決方法之一,這也可以是讀者延伸研究的方向。除此之外在 2012-2018 年組合策略都有較好的穩定度!

交易實作

step1. 策略 function 訂定

def get_last_date_macd_hist():

client = RestClient(api_key = key)

stock = client.stock # Stock REST API client

start_date = datetime.datetime.now().date() - timedelta(days = 60)

end_date = datetime.datetime.now().date()- timedelta(days = 1)

# 取得歷史資料

history_options = {"symbol": symbol, "from": start_date, "to": end_date,

"timeframe":"D", "fields":"open,high,low,close,volume,change,turnover"}

historical_data = stock.historical.candles(**history_options)

close_price_list = []

for ohlc in historical_data['data'][::-1]:

close_price_list.append(ohlc['close'])

MACD, MACDSignal,MACDhist = talib.MACD(np.array(close_price_list),12,26,9)

return MACDhist[-1]

def get_today_macd_hist(now_price):

client = RestClient(api_key = key)

stock = client.stock # Stock REST API client

start_date = datetime.datetime.now().date() - timedelta(days = 60)

end_date = datetime.datetime.now().date()- timedelta(days = 1)

# 取得歷史資料

history_options = {"symbol": symbol, "from": start_date, "to": end_date,

"timeframe":"D", "fields":"open,high,low,close,volume,change,turnover"}

historical_data = stock.historical.candles(**history_options)

close_price_list = []

for ohlc in historical_data['data'][::-1]:

close_price_list.append(ohlc['close'])

close_price_list.append(now_price)

MACD, MACDSignal,MACDhist = talib.MACD(np.array(close_price_list),12,26,9)

return MACDhist[-1]

step2. 下單實作

def get_last_ohlc():

client = RestClient(api_key = key)

stock = client.stock # Stock REST API client

start_date = datetime.datetime.now().date() - timedelta(days = 1)

end_date = datetime.datetime.now().date()- timedelta(days = 1)

# 取得歷史資料

history_options = {"symbol": symbol, "from": start_date, "to": end_date,

"timeframe":"D", "fields":"open,high,low,close,volume,change,turnover"}

historical_data = stock.historical.candles(**history_options)

return historical_data['data'][0]

import json

from fugle_trade.constant import *

from fugle_trade.order import OrderObject

from fugle_trade.sdk import SDK

from datetime import timedelta

from fugle_marketdata import (WebSocketClient, RestClient)

class portfolio_strategy:

def __init__(self, symbol):

self.API_KEY = "INPUT_YOUR_KEY"

self.symbol = symbol

# 今日是否已買進

self.buy = False

self.position = 0

self.last_macd = get_last_date_macd_hist()

self.last_ohlc = get_last_ohlc()

self.open_price = self.get_open_price()

def get_open_price(self):

client = RestClient(api_key = self.API_KEY)

stock = client.stock # Stock REST API client

return stock.intraday.quote(symbol = self.symbol)["openPrice"]

def place_stock_order(self, buy_sell, qty, PriceFlag_type, APCode_type):

order = OrderObject(

buy_sell=Action[buy_sell],

price_flag=PriceFlag[PriceFlag_type],

price = '',

stock_no=self.symbol,

quantity=qty,

ap_code=APCode[APCode_type],

trade=Trade.Cash # 現股賣出 的交易類別

)

self.sdk.place_order(order)

# 取得最新報價

def get_latest_price(self, message):

json_data = json.loads(message)

if json_data['event']=="data" and json_data.get('data',{}).get('isTrial') == None: # 避免用到試撮資料

# 更新目前價格

now_price = json_data['data']['price']

today_open = self.open_price

# 時間是收盤.今日尚未買進

if datetime.time(13, 26) >= datetime.datetime.now().time() >= datetime.time(13, 25) and \

self.buy is False:

today_macd = get_today_macd_hist(now_price)

# 翻紅買進

if today_macd * self.last_macd < 0 and today_macd > 0 and self.position == 0:

place_stock_order("Buy", 1, "LimitUp", "Common")

self.buy = True

# 翻黑賣出

elif today_macd * self.last_macd < 0 and today_macd < 0 and self.position != 0:

place_stock_order("Sell", inv_len, "LimitDown", "Common")

if now_price > self.last_ohlc['high'] and now_price > today_open and self.position == 0:

place_stock_order("Buy", 1, "LimitUp", "Common")

self.buy = True

elif now_price < today_open and len(self.get_inventories()) != 0 and self.position != 0:

place_stock_order("Sell", inv_len, "LimitDown", "Common")

def handle_disconnect(self, code, message):

print(f'disconnect: {code}, {message}')

def main(self):

client = WebSocketClient(api_key=self.API_KEY)

self.stock = client.stock

self.stock.on('message', self.get_latest_price)

self.stock.on("disconnect", self.handle_disconnect)

self.stock.connect()

self.stock.subscribe({

'channel': 'trades',

'symbol': self.symbol

})

if __name__ == '__main__':

symbolId = "2330" # 取得股票代碼

strategy = portfolio_strategy(symbolId)

strategy.main()

結論

開發策略時除了精雕細琢一支策略,也應考慮過度擬合的陷阱,不妨考慮以多策略組合的方式來補足�單策略的缺點。這種交易方式不僅更簡單,在獲利穩定度、風險都能夠較單一策略有更好的表現,若是能進一步考慮動態調整策略資金配會是更好的解決方案!