【程式交易實戰 07】策略精進 - 均線加碼實作

內含 fugle_trade 下單套件,該套件已不再更新,下單語法請改用 合作券商 之 SDK

歡迎來到 程式交易實戰 的第七堂課,還記得上堂課實作的定期定額加碼策略嗎?在股價來回震盪時,定期定額搭配加碼策略能夠更有效地提升投資績效!相信大家對於加碼機制已有更深的了解,今天將延續加碼機制的部分,讓讀者更進一步了解,如果將加碼機制運用到波段策略中結果會如何?

讀完本篇文,您將學會...

- 回測均線策略搭配加碼機制

- 均線策略搭配加碼機制的實單演練

均線策略加碼

均線策略是許多投資人會使用的策略之一,代表著過去一段時間內投資人買進的平均成本,當股價上漲穿過均線時代表這一段期間的投資人解套了,若標的具有題材性、多頭走勢明顯,通常會是不錯的初始進場點,若再搭配加碼策略機制,也許會在多頭走勢中再更加提升獲利績效表現!

績效回測

我們延續 上一篇 的研究標的,一樣使用 0050 這檔個股,初始本金為 100 萬,策略邏輯如下:

- 第一次進場:當股價首次突破 5 日均線時先買入 50 萬元的部位

- 加碼:當日收盤價創第一次進場以來的新高就加碼 10 萬元

- 出場:跌破 10 日均線時清空所有部位

step1. 取得歷史數據,如下:

# 載入相關套件

import matplotlib.pyplot as plt

from datetime import timedelta

import pandas as pd

import numpy as np

import datetime

import time

from fugle_marketdata import (WebSocketClient, RestClient)

# 輸入行情 API Token

key = 'INPUT_YOUR_API_KEY'

client = RestClient(api_key = key)

stock = client.stock # Stock REST API client

symbol = "0050" # 股票代碼

candles_list = []

for y in range(2010,2023):

start_date = str(y)+"-01-01" # 選擇資料起始日期

end_date = str(y)+"-12-31" # 選擇資料結束日期

history_options = {"symbol": symbol, "from": start_date, "to": end_date,

"timeframe":"D", "fields":"open,high,low,close,volume,change,turnover"}

historical_data = stock.historical.candles(**history_options)

# 將資料轉為 dataframe 方便回測

candles_list = candles_list + historical_data['data']

df = pd.DataFrame(candles_list).sort_values('date').set_index('date')

step2. 訂定衡量績效的指標公式

def calculate_performance(pl_record):

df = pd.DataFrame(pl_record)

pl_list = list(df['pl'])

return_rate = sum(pl_list) / 1000000

winrate = len([x for x in pl_list if x > 0]) / len(pl_list)

odds = ( sum([x for x in pl_list if x > 0]) / len([x for x in pl_list if x > 0]) ) / abs( sum([x for x in pl_list if x <= 0]) / len([x for x in pl_list if x <= 0]) )

profit_factor = sum([x for x in pl_list if x > 0]) / abs(sum([x for x in pl_list if x <= 0]))

print("報酬率", round(return_rate*100,2) ,"%")

print("勝率", round(winrate*100,2) ,"%")

print("賺賠比", round(odds,2))

print("獲利因子",round(profit_factor,2))

step3. 撰寫策略回測邏輯

這邊使用 talib 套件來計算均線。當策略出場時就記錄該筆交易的損益和持有部位的數量,之後即可藉由這些資訊來做為損益分析、優化的依據。

from talib.abstract import *

# define backtest function

def run_backtest(plus_position):

df['5MA'] = SMA(df['close'], timeperiod=5)

df['10MA'] = SMA(df['close'], timeperiod=10)

df['last_close'] = df['close'].shift(1) # 前一日 收盤價

df['last_5MA'] = df['5MA'].shift(1) # 前一日 5MA

# 紀錄買進

buy_record_list = []

funds = 1000000

last_funds = 1000000

new_high_price = 0

position = []

pl_record = []

for d in df.iloc:

# 如果突破5日線 且 沒有部位

if d['last_close'] <= d['last_5MA'] and d['close'] > d['5MA'] and len(position) == 0:

# 首次站上5日線就買進10萬

position.append( 500000 / d['close'])

new_high_price = d['close']

funds = funds - 500000

# 加碼機制:如果已經第一次進場了 且還有剩餘的資金

if plus_position == 'yes' and len(position) != 0 and funds >= 100000:

# 條件:檢查是否有創首次買進的創新高

if d['close'] > new_high_price:

position.append( 100000 / d['close'])

new_high_price= d['close']

funds = funds - 100000

# 如果股價跌破 10 日線就全出

if d['close'] < d['10MA'] and len(position) != 0:

funds = funds + d['close'] * sum(position)

pl_record.append({'date': d.name, 'accu_pf': funds ,'pl': funds - last_funds , 'max_position': len(position)})

position.clear()

last_funds = funds

plot_df = pd.DataFrame(pl_record).set_index('date')

plot_df['accu_pf'].plot(figsize=(10,5))

return calculate_performance(pl_record)

回測結果

print('有加碼:')

run_backtest(plus_position='yes')

print('----')

print('無加碼:')

run_backtest(plus_position='no')

print('----')

Response

有加碼:

報酬率 33.84 %

勝率 17.21 %

賺賠比 6.65

獲利因子 1.38

----

無加碼:

報酬率 20.73 %

勝率 18.1 %

賺賠比 5.9

獲利因子 1.3

----

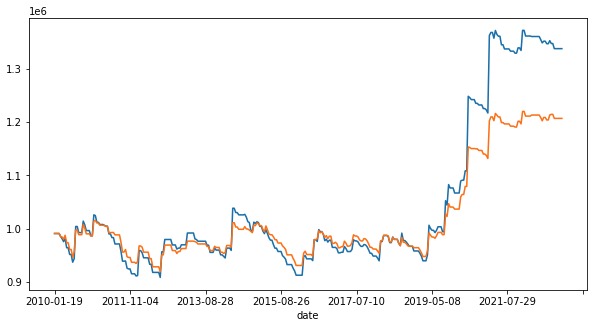

根據上圖的累計損益圖以及回測結果顯示,加入加碼機制後(藍色線圖)的報酬率、賺賠比以及獲利因子都有顯著的提升!此範例為順勢的加碼機制策略,因走勢的確立而提升信心進行加碼, 實驗結果也證實加碼機制的運用能夠有效提升績效!因此,我們進一步進入均線的實單演練。

實作均線自動下單程式

以下我們就將改進版的加碼策略寫成能夠實際下單的程式吧!

step1. 登入富果 API

from configparser import ConfigParser

from fugle_trade.sdk import SDK

from fugle_trade.order import OrderObject

from fugle_trade.constant import (APCode, Trade, PriceFlag, BSFlag, Action)

from fugle_marketdata import (WebSocketClient, RestClient)

# 輸入行情 API KEY

key = 'INPUT_YOUR_API_KEY'

client = RestClient(api_key = key)

stock = client.stock # Stock REST API client

# 讀取設定檔

config = ConfigParser()

config.read('./config.simulation.ini') # 使用模擬金鑰設定檔

# 密碼輸入及登入

sdk = SDK(config)

sdk.login()

step2. 計算 MA 數值

首先取得前 N 日的收盤價和當日開盤價並計算,並包成 function 方便我們後續運用

from datetime import timedelta

def cal_ma(symbol, timeperiod):

# 為了取足夠遠的歷史數據

start_date = datetime.datetime.now().date() - timedelta(days = timeperiod*2)

end_date = datetime.datetime.now().date()

history_options = {"symbol": symbol, "from": start_date, "to": end_date,

"timeframe":"D", "fields":"open,high,low,close,volume,change,turnover"}

historical_data = stock.historical.candles(**history_options)

ma_price_list = []

for ohlc in historical_data['data'][:timeperiod-1]:

ma_price_list.append(ohlc['close'])

# 取當日開盤價

today_open_price = stock.intraday.quote(symbol = symbol)['openPrice']

ma_price_list.append(today_open_price)

MA = sum(ma_price_list) / timeperiod

return MA

測試看看 5MA、10MA 目前是多少

print("5MA", cal_ma("0050", 5))

print("10MA", cal_ma("0050", 10))

取得當日的 5MA 及 10MA 後即可開始,我們一樣以回測使用的邏輯來進行交易,因為我們需要知道目前已加碼幾次,所以這邊以整股的方式來示範,每次加碼就買進 1 張。若資金有限,可以將交易盤別(APCode)改為盤中零股(IntradayOdd)。

import json

from fugle_trade.constant import *

from fugle_trade.order import OrderObject

from fugle_trade.sdk import SDK

from datetime import timedelta

from fugle_marketdata import (WebSocketClient, RestClient)

class ma_strategy:

def __init__(self, symbol):

self.API_KEY = "INPUT_YOUR_KEY"

self.symbol = symbol

self.ma_5 = cal_ma(symbol, 5)

self.ma_10 = cal_ma(symbol, 10)

# 今日是否已買進

self.buy = False

self.position = 0

def place_stock_order(self, buy_sell, qty, PriceFlag_type, APCode_type):

order = OrderObject(

buy_sell=Action[buy_sell],

price_flag=PriceFlag[PriceFlag_type],

price = '',

stock_no=self.symbol,

quantity=qty,

ap_code=APCode[APCode_type],

trade=Trade.Cash # 現股賣出 的交易類別

)

self.sdk.place_order(order)

# 取得相同股票的庫存 當出清部位的訊號產生時就全部清空

def get_symbol_inventories(self):

inventories = sdk.get_inventories()

for inventor in inventories:

if inventor['stk_no'] == self.symbol:

return inventor['stk_dats']

return []

# 取得上次買進最高的價格 判斷是否創新高

def cal_max_cost(self):

pos_list = self.get_symbol_inventories()

newlist = sorted(pos_list, key=lambda d: d['price']) # 依據價格由低到高排序

return newlist[-1]['price']

# 取得最新報價

def get_latest_price(self, message):

json_data = json.loads(message)

if json_data['event']=="data" and json_data.get('data',{}).get('isTrial') == None: # 避免用到試撮資料

# 更新目前價格

now_price = json_data['data']['price']

# 突破 5 日線 並且沒有部位(代表是首次) 買進

if now_price > self.ma_5 and self.buy == False:

place_stock_order("Buy", 1, "LimitUp", "Common")

self.buy = True

self.position = 1

# 今日已買進 + 股價創新高 + 就加碼 1 張(考量資金,部位以不超過五張為限)

if self.buy == True and now_price > self.cal_max_cost() and self.position <= 5: # 計算上次買進的最大成本(最高價)

place_stock_order("Buy", 1, "LimitUp", "Common")

self.buy = True

self.position = self.position + 1

# 跌破 10 日線 並且有部位 賣出

if now_price < self.ma_10 and self.position > 0:

place_stock_order("Sell", self.position, "LimitDown", "Common")

self.buy = False

self.position = 0

def handle_disconnect(self, code, message):

print(f'disconnect: {code}, {message}')

def main(self):

client = WebSocketClient(api_key=self.API_KEY)

self.stock = client.stock

self.stock.on('message', self.get_latest_price)

self.stock.on("disconnect", self.handle_disconnect)

self.stock.connect()

self.stock.subscribe({

'channel': 'trades',

'symbol': self.symbol

})

if __name__ == '__main__':

symbolId = "2330" # 取得股票代碼

strategy = ma_strategy(symbolId)

strategy.main()

結論

本週我們實作了均線加碼策略的回測及下單程式,在回測中我們也驗證了策略加入加碼機制確實能夠提升績效結果,也示範若要將回測結果進行實單測試應該如何進行!讀者也可藉由此篇文章進一步思考,是否有更適合的加碼策略可以運用或結合到您的原始策略中。加碼機制的介紹也將告一段落,接下來預計會帶大家了解策略精進的另一個大主題:停損停利機制的部分,請大家敬請期待!